marginfi ($TBA) - Lending your SOL a hand

Competition for liquidity is intense, as it often is during market downturns. But this is when quality fundamentals and strong teams emerge to build excellent products despite these BS conditions.

THE DIRTY SCORE: Beside each section / important metric I place a (score in brackets). Ranked from 1 - 5 ~ the higher the better. At the end of the report I display the scorecard with an overall average from each of the sections. No weighting to any specific sections.

In crypto everything is a meme, so don’t get too caught up on one section

NARRATIVES: Solana, DeFi, Money Markets, LSD, Airdrops (5)

CHAINS: SOL

PREFACE:

marginfi is a money market protocol on Solana, created by MRGN Inc. It offers an array of lending, trading, and portfolio management tools for crypto users. The initial focus was on composable trading across DEXs using marginfi as a platform. However, they strategically pivoted to lending based on market conditions.

This lending platform called mrgnlend enables overcollateralized crypto loans and attractive interest rates. Users can borrow funds by providing collateral or earn yields by lending assets out.

marginfi also recently launched a liquid staking derivative token called $LST. This allows users to earn staking rewards on $SOL while retaining liquidity. The gents built this on top of Jito’s MEV platform and at present do not charge fees on it.

There’s a lot to unpack, time to dig in👇

But before we begin let’s talk about Zeta Markets the official sponsor of The Dirty Diggler. That is right my friends. With an options past and a perpetual future (eh eh pun intended), this team is building a premier Solana Exchange and Dirt is happy to be along for the ride. Zeta continues to impress me one feature at a time. With no token (yet) and V3 on the horizon, it’s more than enough to get excited about!

Check out Zeta’s recent post which highlights Tristan’s appearance at Breakpoint! Are you going? Don’t forget to check out Zeta for yourself! → www.zeta.markets

TOKENOMICS: (4)

Alright, there’s no token and Dirt is tired of simply stating “airdrop potential”. Yes, that is the case, but it shouldn’t be the only reason you are here. We are here because we believe in the Solana eco, not just the 2.0 protocols, but the whole dang pie. And marginfi is, if I may say, becoming a large part of it.

They currently employ a point system that everyone's speculating on as seen by a jump in TVL that started in July.

NOTE: Mac mentioned the points has lead to a “soft governance” for the protocol, since users are invested thru the point system and thus provide feedback to the protocol.

MECHANICS: (4.5)

Composability: the name of marginfi’s game. consistently creating markets for Solana native tokens. Question is… will they take it further? Would love to see the ability to use deposits as collateral for trading 👀?

End Game: An all-encompassing defi experience: lending, staking, swapping, bridging… AI-ing

marginfi wants your tokens and wants to help you make frens with Solana protocols

What it do?

Lend ~ Money market

mrgnlend’s bread and butter: deposit assets, borrow assets = earn points.

Referrals also give a user 10% of the points from a new member.

Liquidity Incentive Program (LIP):

provides yield-boosting incentives to users while directing stable liquidity into marginfi and partner protocols for longer horizons - a win-win-win model.

Stake ~ Liquid Staking Token

Built on margin's validator network and Jito's MEV rewards. It currently projects 8% APY for your SOL when you stake there.

Swap ~ Powered by Jupiter

Use Jupiter to swap in app for any Solana-supported assets.

Bridge ~ Powered by Mayan

Use Mayan to bridge assets in app.

Omni ~ AI

As an avid AI user, I must say this is quite bad for natural language prompts with regard to research and specific questions. Seems to be geared towards coding and will look into this further.

Want to read the fine print? Read the docs here!

FINANCIALS: (3.5)

The team raised $3M in a seed round last Feb 2022. For context, Zeta raised $8M at the end of 2021 and has a reported 3-year runway. Will get a better answer from the team shortly… maybe even a podcast? Someone connect Dirt 😉

Fees:

No fees are earned via money markets or the new LSD platform… yet 👀

This is the way for the marginfi team to attract more users. However, I worry that the $3m seed fund is small and the team may be up against the wall… stay tuned to find out!

NOTE: The only fees that are taken are for the insurance pools.

GROWTH: (5)

TVL has increased at a rapid pace since introducing the point system for lending ~ which was initially launched in July 2023. Tracking the TVL since then has shown a growth of nearly +700%.

The $LST protocol is pretty new, launching end of September. It has just crossed $1M in TVL. Best part? That TVL was achieved in just a week.

With all sorts of partnerships and hype, Dirt expects marginfi to continue to impress.

ROADMAP: (4)

The boys are building! Just this week alone they have:

Listed 2 new assets: $RLB & $BLZE

Raised caps on 3 assets

Crossed $1m in TVL on the new $LST

Launched a new mobile UI

TEAM / COMMUNITY: (4.5)

marginfi has an experienced founding team including Edgar Pavlovsky (machine learning expertise from Jia) and MacBrennan Peet (institutional finance background from Morgan Stanley and hedge fund founder).

Together they combine skills in private equity, consulting, healthcare, growth equity, and software development. Both founders are active in promoting marginfi through podcasts and interviews.

The team of around 8 developers brings technical strengths in machine learning, DevOps, and building robust systems.

ECOSYSTEM / PARTNERSHIPS: (5)

Pyth & Switchboard - Primary & Secondary Oracle for price feeds

Jito - MEV Rewards for LSD

Squads - Multi-Sig authority over protocols

Amulet Protocol - Amulet lets users protect their marginfi assets by buying smart contract insurance. Users can also stake $aUWT tokens in the marginfi pool to earn rewards and increase the available insurance coverage.🚜

Mayan & Jupiter - In application bridging and swapping functions

COMPETITION: (5)

Competition in Solana for lending is mediocre, the main thing is that the whole ecosystem is trying to conjure up TVL. With marginfi looking to be a future $AAVE (leader in lending over at ETH), marginfi needs to deal with these old players in the space - Solend, Port Finance, Larix… don’t think that is going to be too hard.

The de-facto leader in lending protocols under the Solana ecosystem, Solend has recovered quite nicely from the FTX collapse contagion. Overnight the protocol TVL dropped from $255m to $130m before bottoming out ending 2022 at $15m. But Solend is sitting now at $50m TVL. Having launched Solend V2 last August, with additional protections in place. They have had a token since 2021, wherein it is now down -96% from the highs.

Another lending protocol that enjoyed the last bull run. It’s interesting that although its TVL is currently at just $5m, it was at $250m as the market was at its peak last 2021. They also have a token launched back then and has collapsed to near adding a couple of decimals to its token price to a -99% from the highs.

Larix uses dynamic rates and strong risk management to accept diverse collateral like crypto, stablecoins, NFTs, and real assets, including invoices and mortgages. Its unique token economy incentivizes users and distributes rewards, establishing it as the first of its kind in Metaverse finance on Solana. Despite peaking at $350m+ TVL during the 2021 bull run, it's now at $4.13m, with its token price down by 99% from its highs.

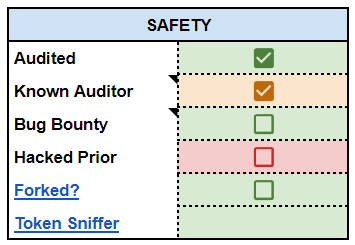

SAFETY: (3.5)

margin V2 was audited by the team internally and by Ottersec. The team also conducted fuzz tests - a more random approach to trying to spot vulnerabilities. Fuzz tests by marginfi are also open-sourced.

NOTE: Check out Fuzz Tests and how they differ from other more traditional software testing methodologies over here. TLDR: find bugs when you don’t know what to look for.

BULLISH: (4)

Team is building and partnering non-stop

LSD token $LST launching and onboarding $1M in TVL trés fast!

Point system in place ~ tho execution to tokens is where it really matters

TVL currently puts it at 10th among Solana protocols

Mobile is on the immediate roadmap.

Great UI/UX

There were ledger connectivity issues for a while but they seem to be taken care of

Solana infrastructure:

Near-zero trading fees and speed-of-light trade settlement/finality.

BEARISH: (4)

Not taking fees at the moment - for both lending and staking protocols. This with a $3m seed fund in early 2022 might mean the team is really running on a tight budget.

Hopeful that the points system hasn’t led to excess airdrop farming → which leads to TVL shrinkage post-token launch.

Am a fan of airdrops for communities and believe in Solana’s robust ecosystem to stick around and remain sticky. It’s my gut feeling and I am sticking to it!

No bug bounty

CONCLUSION: (4.33)

Marginfi is establishing a robust presence within the Solana ecosystem through its diverse financial services, including lending and liquid staking. Its unique points system, strategic partnerships, and continuous development efforts demonstrate a strong ambition to become a comprehensive DeFi platform.

Yet, I have financial sustainability concerns due to the lack of fee generation and a limited seed fund. The project's future hinges on maintaining user engagement, successfully transitioning to a token economy, and ensuring protocol security amidst market volatility.

In summary, Marginfi's progress is impressive, but its journey will have challenges. The team's expertise and innovative approach are crucial for its sustained growth and achieving its vision within the Solana ecosystem.

That is all frens… Stay Dirty

Nothing in this report should be misconstrued as financial advice. Any investments should be taken at the sole discretion of the reader and/or counterparty. DYOR

DISCLAIMER: The following tools are used to conduct much of my research: Block Explorers, Protocol Analytics, Dune, Github, Defi Llama, Token Terminal, Debank, Nansen, Messari, DApp Radar, Flipside, Twitter & Token Unlocks.

Looking to hire a Researcher, Analyst, Advisor, or Content Creator? DM me 🫡